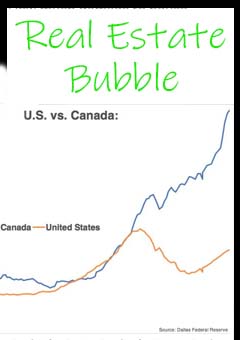

Taxes are going up, TO condo prices are going down and recreational property up 15% to 40% in the Canadian market.

Why are Interest rates not falling.

Goldman Sachs’ top AI picks

Does Printing Money Cause Inflation?

HSBC, the Untouchable Titan of Global Finance

US Economist’s Shock Warning: “Biggest Crash in Ou

Toni Gravelle Speech

Alberta Premier on the Supreme Court\'s ruling, an

What Bank of America Just Said is Shocking

Horrific Canadian Banking Corruption Right Before

The Banking System is in Free-Fall

The Financialization of Real Estate

The FDIC Threatens Downgrades That Will Cut Off Ac

Bitcoin regulations are coming

Are we in a bubble and, if so, when will it pop?

Canadian real estate and government, March 29

FIRE report January 12th

BOC and reconciliation with Indigenous people

Nov 26 FIRE report

FSIM FIRE report Nov 23

Nov 18th FIRE report

Poloz debunked, Nov 12 FIRE report

Central bank digital currencies: foundational prin

Nov 5th FIRE report

FIRE report November 2nd

Canadian real estate February 24

Real estate: Feb 9, bulls vs bears

Feb 1, The Dumb Money Real Estate Vid

January real estate report 2021

December 4th real estate report

Real estate, mortgage debt to income ratio improve

Real estate: fiscal conservatism/ponzi neoliberali

Caution for real estate investors, Oct 14th report

Canadian bank industry overview - part 1

Why insurance should partner with flood-claim.com

Canadian large bank comparison

Current state of fintech in Canada

XE.com explains their Big Data and AI strategy.

Greenpeace urges TD bank boycott

Insurance flood US vs Can comparison.

Canadian bank industry overview part 5

Canadian banking industry overview part 4

Part 3 Canadian bank industry overview

Canadian banking overview - part 2

Death to bitcoin, long live bitcoin

RBC to integrate Wave Technologies

Deposits have skyrocketed since the start of the p

About

About BankNews TV: financial services industry monitor (FSIM), analytics and research

Latest news and events for Canadian financial service companies, analytics, fintech and AI. BankNews.TV provide the latest technology news and reports for banks and insurance companies looking to compete in a rapidly changing market.

Financial data upload

Analytical information and financial information related to technogies that can change your business.

Financial data templates

Please download and complete the data template that you need to upload. See financial data upload section above for details of how this data will be used.

| capital_and_leverage | capital_and_leverage |

| derivative_contracts | derivative_contracts |

| impaired_assets | impaired_assets |

| income_statement | income_statement |

Research

Part 2: The Merchant Loyalty Industrial Complex Collapse

fsim.ca/docs/Credit_cards_Part_2v4.pdf

Mark Sibthorpe

Since November 2, 2021, Loyalty Ventures Inc.'s (Airmiles) market cap has decreased from $861.42M to $2.11M, a decrease of -99.75%. This compares closely to 2018, when Aimia sold Aeroplan back to Air Canada and partners TD and CIBC for $238 million. For reference, in 2005 Aeroplan launched an IPO valuing it at $2 billion. Related to Aimia’s downfall, it had also previously sold the UK Nectar program to Sainsburys for $120 million, $580 million lower than it paid for Nectar in 2007.

This report digs under the surface and uncovers why loyalty is going the way of the dodo.

Merchants should not waste time fighting card networks

fsim.ca/docs/Card_fees_ongoing.pdf

Mark Sibthorpe

This is part one of a two part assessment of merchant frustration due to high credit card fees. The second part of this report will outline an alternative approach that merchants can consider. An approach that is a win for them and also for the card networks.

The full story of SVB March 12th, 2023

fsim.ca/docs/SVB_special_report2.pdf

Mark Sibthorpe

Aggregated news and research related to SVB. Apart from SVB, included in this report is related news with respect to other banks and non-traditional companies looking to add financial services that also appear risky.

March 2023 bank earnings summary

fsim.ca/docs/bankearningsfriday.pdf

Mark Sibthorpe

This report provides a snapshot into recent bank earnings and related news as published in fsim.ca reports.

Real estate report: October 30th, 2020

fsim.ca/docs/Oct30rereportv1.pdf

Mark Sibthorpe

The big buzz in real estate recently is Mark Carney being scooped up by Brookfield. This means more juice for riskier borrowers. Brookfield, a huge player in real estate, both residential and commercial, recently bought its remaining shares from Sagen (Genworth MI Canada), which values the company at $3.8 bn.

VersaBank’s New High-Security VPN Proving Especially Valuable During COVID-19 Pandemic

fsim.ca/docs/TailscaleReleaseMarch30FINAL.pdf

Press Release

2014 FSIM when Bernanke visited Montreal

fsim.ca/docs/MockBernanke.pdf

Mark Sibthorpe

Considering Bernanke is hated by the Republicans and hated even more by the Democrats, and is currently under scrutiny for saving AIG but not Lehman, (in hindsight) with respect to issues over solvency vs liquidity, the Montreal lovefest attended by 1,100 people yesterday must have been a welcome respite. Click the link to read the entire 2014 report.

Eisman's big Canadian bank short

fsim.ca/docs/eisman2.pdf

Mark Sibthorpe

I have been reporting on Steve Eisman's short position for quite some time. As the analyst reaction to Eisman shows (link below), Eisman has taken a lot of heat for shorting Canadian banks. Instead of capitulating, in September 2019 he publicly disclosed the fact that he added Canadian Tire to his position, He explains the rationale for this in a BNN interview late 2019. Essentially, his big concern with respect to banks was non-performing loans in Alberta. He feels Canadian bank CEOs are not prepared for a credit cycle. He specifically referenced ATB (a private bank) in discussing his concerns. Looking at the numbers today, my guess is that he has made off like a bandit.

VersaBank Beta-Testing Its New, High Volume Mortgage Finance App

fsim.ca/docs/VBCortelMortFinanceAppFeb62020.pdf

Press Release

VersaBank announces it is initiating beta-testing on its newly developed high-volume mortgage software app with the Cortel Group, one of Canada’s largest home and condominium builders. The app, named “Direct Connect”, was designed to facilitate and significantly reduce the lengthy finance approval process typically experienced by home buyers when visiting home and condo pre-construction sales offices.

How and why you need to defend your brand against disruptors

Mark Sibthorpe

Technology, and being open to opportunities, has preempted transformation in banking. At the top of change are Mint, PayPal and ApplePay; three examples of transformative solutions that are now ubiquitous. On the horizon: Uber and Google, both having recently announced partner based banking services. Further down in the plumbing is Duca Impact Labs, Versabank, and Revolut. This report shows how cost conscious FIs can, not only stay relevant in the face of adversity, but punch well above their weight. All thanks to creative thinking and the ongoing commoditization of technology.

Kick the can(nomics)

fsim.ca/docs/Kick.pdf

Mark Sibthorpe

Canada has used consumer debt to provide life support to the economy. This strategy which basically pushed the day of reckoning to the next government was old back in 2014, and now is well past its sell-by-date. Recognizing this, and desperate to keep the economy out of a recession, Trudeau is spending more money now than any government in Canadian history. This report disusses a possible alternative.

ScoreCard Bill Morneau, Canada's Minister of Finance

fsim.ca/docs/ScoreCardMorneau.pdf

Mark Sibthorpe

This report is a scorecard I designed in order to rank the performance of the current Minister of Finance, Bill Morneau. I do regular rankings because, otherwise, I cannot measure the performance in a meaningful way. The scoring is based on a variety of metrics as detailed on the ‘score-table’ on page 3. Examples of the criteria and weighting include:

Observations and overview of 2018 NB flood support from government and insurance companies.

fsim.ca/docs/Observations and overview of 2018 NB flood support from government and insurance companies..pdf

Mark Sibthorpe

Flood aftermath is linked to post traumatic stress. Here are some findings from a study conducted by Queensland University following a flood:

"The findings showed that aftermath stress contributed to poor mental health outcomes over and above the flood itself, prior mental health issues and demographic factors," Ms Dixon said.

"Aftermath stress was the strongest predictor of post-traumatic stress symptoms with 75 per cent of people saying the most difficult aspect was the aftermath and dealing with insurance companies," she said.

With this in mind, I felt it was important to understand how New Brunswick flood victims were treated.

Update Argentina: a sign of the times

fsim.ca/docs/Update Argentina_ a sign of the times.pdf

Mark Sibthorpe

Argentina is in the news daily because the situation is dire, and may be an indication of further contagion. The most dramatic story that speaks of the a leading cause of its troubles was the recent arrest of the public works secretary, Jose Lopez. June 15th he was caught hiding millions in cash in a monastery. No this is not a plot for a comedy.

Summary of Canada's flood news, 2017 to present

fsim.ca/docs/Summary-of-flood-news-2017-present.pdf

Mark Sibthorpe

This report covers flood news in Canada from 2017 to present and highlights the relevent issues for home-owners and the insurance industry.

Banking on Pot

fsim.ca/docs/c10191_banking-on-pot.pdf

SBS

As states across the US legalize marijuana for both medicinal and recreational purposes, it has fueled a growing industry of marijuana related businesses (MRBs).

Canadian banking industry overview

Mark Sibthorpe

The industry overview is divided into 5 parts:

Introduction

Small banks

Small medium sized banks

Medium sized banks

Medium large banks

2014 Mobile payments the Apple pay way

fsim.ca/docs/Mobile_Payments_Apple_Pay_2014.pdf

Mark Sibthorpe

With Walmart Pay about to userp Apple Pay, I thought I would share my 2014 book on mobile payments and loyalty. The guilde was written for Merchants that want to understand loyalty, credit, mobile payments and Apple Pay, but anyone involved with credit and loyalty might find it useful.

The book is a prelude to Walmart leaving MCX, and chronicles the evolution that led to Walmart Pay. There is an extensive case study of Walmart that looks into its efforts to become an ILC and to avoid paying credit card transaction fees ('merchant discount').

It offers readers a step-by-step methodology for evaluating and transforming credit and loyalty programs. The strategies are based on proven examples and industry facts. The Nectar, Target, Canadian Tire and Walmart case studies are examples of the practical approach I have taken, written with the intent that merchants can use them as blueprints for their own initiatives.

Death to bitcoin, long live the blockchain (See full report)

Mark Sibthorpe

Jamie Dimon calls bitcoin a fraud used by criminals, yet he has jumped into the blockchain with both feet.

TD bank industry conduct

fsim.ca/docs/tdind2.pdf

Mark Sibthorpe

TD’s share price recently collapsed by $7 bn in one day due to CBC’s allegations of aggressive selling tactics. A huge fall from a bank that was trading at a premium as recently as January. This was even before the most recent allegation of TD attempting to avoid paying taxes on advertising.

This report chronicles the events leading up to the collapse, shows TD's performance, analyses other related issues.

Book review: Back from the Brink

fsim.ca/docs/backbrink.pdf

Mark Sibthorpe

This is a book review of the book Back from the Brink by Paul Halpern, Caroline Cakebread, Christopher C. Nicholls and Poonam Puri.

Footnote 151

fsim.ca/docs/footnote151.pdf

Mark Sibthorpe

Footnote 151 implies an important regulatory change related to derivative contracts. It means that US Banks will not be required to hold as much capital against commodities. If you want to understand the implications of this regulatory change in more detail, see the enclosed related article detailing the changes. For contextual purposes, I have also included two Rolling Stones Magazines reports from 2010 and 2014 that chronicle the role large US banks have played in manipulating commodities. You might question the credibility of these sources, but rest assured, these reports are based on United States Senate hearings which outline the issues in a 396 page report related to the implied risks.

Save the Canadian economy now

fsim.ca/docs/helecopter-money.pdf

Mark Sibthorpe

Consumer debt spending appears to have insulated Canada from the worst of the credit crisis, but now the alarming magnitude of consumer debt ($1.92-trillion) could exacerbate a day of reckoning.

This report assesses the issues at hand and recommends the solution to get Canada's economy on track.

Reasons financial service companies should consider gamification

fsim.ca/docs/GamingEventProposal-printsample--en-final.pdf

Mark Sibthorpe

Gamification of business processes resulted on Mint.com growing to 10 million users within 4 years. This report explains how.

National Bank Special Report

fsim.ca/docs/NatBSpec.pdf

Mark Sibthorpe

According to Bloomberg, National Bank of Canada will take a C$64 million ($48 million) restructuring charge in the fourth quarter and said its investment in Maple Financial Group Inc., which is being probed by German regulators, may be at risk of a “substantial loss.”

Will Canadian banks charge companies for deposits?

fsim.ca/docs/depgrowthimpact2.pdf

Mark Sibthorpe

In light of today’s possible rate cut, this report discusses how a bank rate cut and capital ratio pressure could precipitate negative corporate deposit interest rates in Canada.

Canadian Tire's (CTC) - Canadian Tire Financial Services (CTFS) Scotia deal overview and risk assess

fsim.ca/docs/ctfsfinal.pdf

Mark Sibthorpe

Review of the Canadian Tire Financial Services deal with Scotiabank, risks, opportunity and benefits.

Finance minisiter scorecard August 26, 2015

fsim.ca/docs/Scorejo-August-2015.pdf

Mark Sibthorpe

This report looks at Joe Oliver, minister of finance’s progress to date, and assigns a grade to his government’s performance to date.

Xtreme Branch

fsim.ca/docs/xbranch.pdf

Mark Sibthorpe

Branches are evolving to meet the digital age. This documents tracks the evolution with real-world examples.

Canadian Nudge

fsim.ca/docs/nudge.pdf

Mark Sibthorpe

CWB cause for concern

fsim.ca/docs/cwbupdate.pdf

Mark Sibthorpe

BNTV Overview

fsim.ca/docs/overviewpdf.pdf

BNTV

BankNews.TV Publishing Corp services overview document:

- Analytics

- Financial services industry monitor (FSIM) industry briefings and developments reports

- Research

Challenger banks not a threat to big banks

fsim.ca/docs/challenger.pdf

Mark Sibthorpe

This report looks at Canadian challenger banks (apart from merchant led banks) and explains why they have not threatened larger institutions. It also looks at ways in which these upstarts have achieved success.

Gamification of financial data project

fsim.ca/docs/GamingEventProposal-printsample--en-final_original.pdf

Mark Sibthorpe

This document contains details on how BankNews.TV is helping kids learn programming via gamification of financial data.

The impact a rate rise will have for Canadian banks

fsim.ca/docs/irr-f.pdf

Mark Sibthorpe

Canadian banks have made money throughout the credit crisis, but this trend may be about to reverse. The rational supporting this prediction is that revenue has grown despite a declining net interest margin (NIM). It has grown in spite of this fact because Canadian debt (loan lease volume) has risen significantly, as shown in chart 2.

FIFA: the new goldenballs

fsim.ca/docs/goldenballs.pdf

Mark Sibthorpe

Yesterday, the Attorney General of Switzerland (OAG) opened criminal proceedings related to the FIFA scandal. This report outlines some of the events related to the criminal investigation, with a particular focus on banking.

Scorecard Minister of Finance: JIm Flaherty

fsim.ca/docs/Scorecard Min Fin Flaherty April 8 2014.pdf

Mark Sibthorpe

March 18, Finance Minister Jim Flaherty resigned from cabinet after having endured a difficult year due to health issues. This report looks at his legacy and attempts to grade his government’s performance to date.

Merchants extend financial services

fsim.ca/docs/merchantfs.pdf

Mark Sibthorpe

Merchant led financial services are growing in importance once again. This is exemplified in the ongoing UK rivalry between ASDA, Sainsbury and Tesco. Together these merchant/financial service companies provide the backstop for three different approaches for merchants looking to extend their financial services.

Hot Money: real-estate

fsim.ca/docs/hotmoney.pdf

Mark Sibthorpe

Currency Cheat Sheet: a guide for the rest of us

fsim.ca/docs/currencycheatsheet.pdf

Mark Sibthorpe

Riches to Rags? Summary of possible risks for Genworth MI CANADA, INC.

fsim.ca/docs/gq4risk.pdf

Mark Sibthorpe

Genworth had its Q4 2014 earnings call. Genworth own about 30% of the mortgage default insurance in Canada. Not surprisingly, the earnings call became focussed on Alberta; and for good reason, with 20% of its outstanding insured mortgage balance in Alberta, sensitivity to the oil shock and how Genworth plan to manage related risks were discussed in detail.

Canadian Western Bank Competitive Forecast

fsim.ca/docs/cwbf.pdf

Mark Sibthorpe

Based on historical financial data (see detailed charts pages 5-8), the oil based recession in Alberta, and comparison against two of its peers, this document outlines my observation with respect to CWB’s future performances.

Liquid Canada: the tipping point

fsim.ca/docs/Liquid.pdf

Mark Sibthorpe

This report examines liquidity issues in the Canadian financial service industry.

Bank Fees

fsim.ca/docs/Bank fees.pdf

Mark Sibthorpe

Recently the CBC and The Globe and Mail both reported on what has been referred to as a consumer “bank fee outcry”. CBC compares banks to cable and phone companies, standing accused of trying to gouge customers with service fees. The backlash appears to have originated in conjunction with the NDP and the Consumers Council of Canada which argues that there is anxiety ‘among consumers about banking fees’.

Cheap Oil Report

fsim.ca/docs/co2.pdf

Canada's Economy, a strategic solution

fsim.ca/docs/ces.pdf

Mobile Payments Blueprint: guide to credit and loyalty transformation for merchants

fsim.ca/docs/booksample.pdf

Guide to system selection

fsim.ca/docs/gssnow.pdf

Read sample report: Guide to system selection. This sample would normally cost $99 but is available free as a sample. Click here view sample report.

News feed

NEW CONDO SALES IN THE TORONTO AREA HIT 15-YEAR LOW

G&M - Rachelle Younglai (2024-08-23)

The slowdown has imperilled the construction of homes at a time when governments are trying to spur more building in a bid to make housing more affordable.

MASTERCARD FOUNDATION LAUNCHES TORONTO-BASED ASSET MANAGER TO OVERSEE $47-BILLION IN INVESTMENTS

G&M - James Bradshaw (2024-05-03)

One of the worldâs largest private charitable organizations, the Mastercard Foundation, is creating a separate Toronto-based asset manager from scratch to modernize the way it invests its US$47-billion portfolio â a vast pool of wealth built from owning a single stock. Mastercard

U.S. PROBE OF TD BANK TIED TO US$653-MILLION MONEY-LAUNDERING AND DRUG-TRAFFICKING CASE

G&M - Tim Kiladze (2024-05-03)

Toronto-Dominion Bankâs TD-T lengthy regulatory and law enforcement investigation in the United States is tied to a US$653-million money-laundering and drug-trafficking operation, a revelation that finally sheds light on American regulatorsâ decision to block TDâs multibillion-dollar U.S.

RENTAL HOUSING INVESTOR STARLIGHT HIT BY RISING REAL ESTATE SUPPLY IN U.S., COMPOUNDING PAIN FROM HIGHER RATES

G&M - Tim Kiladze (2024-05-03)

Starlight Investments, run by Canadian real estate magnate Daniel Drimmer, launched two funds that invested in U.S.

SOCIETE GENERALE PROFIT BEATS ESTIMATES AS EQUITIES HELP LIFT RESULTS

Yahoo Finance - Alexandre Rajbhandari (2024-05-03)

Income from the trading of equities products rose 3% to â¬870 million ($933 million) in the period, beating the â¬843 million that analysts polled by Bloomberg anticipated.

WHY MORTGAGES AND INTEREST RATES ARE A HOT UK ELECTION ISSUE

Bloomberg - Joe Mayes and Tom Rees (2024-05-03)

With Britain expecting a general election later this year, the ruling Conservatives and Labour opposition are drawing up rival plans to help a key demographic: aspiring homeowners.

DANSKE BANK SHARES DECLINE AFTER NET INTEREST INCOME MISS

Bloomberg - Love Liman (2024-05-03)

Danske Bank A/S shares declined after Denmarkâs largest lender reported slightly weaker-than-forecast net interest income, worrying investors over the pace of its recovery after its money laundering scandal. The

EQ BANK TAPS 'SCHITT’S CREEK' DUO TO BATTLE CANADIAN STRANGLEHOLD

FP (2024-05-03)

Equitable Bank Inc.

BANK OF CANADA CAN DIVERGE FROM FED ON RATES WITHOUT STOKING INFLATION, NATIONAL BANK SAYS

FP - Randy Thanthong-Knight (2024-05-03)

Overnight swap markets are pricing in about 55 basis points of cuts in Canada by year end, compared with 35 basis points in the United States.

TD BANK PROBE TIED TO LAUNDERING OF ILLICIT FENTANYL PROFITS, WSJ REPORTS

Reuters (2024-05-03)

The investigation was initiated after agents uncovered an operation in New York and New Jersey that laundered hundreds of millions of dollars in proceeds from illicit narcotics through TD and other banks, the WSJ reported, opens new tab, citing court documents and people familiar with the matter. "Criminals

CANADIAN HOUSING AGENCY BIZARRELY FORECASTS RECORD HOME PRICES & WEAK ECONOMY

Better Dwelling (2024-05-03)

The CMHC sees home prices rising at a face-ripping rate across the country.

ASSISTANT SUPERINTENDENT TOLGA YALKIN PARTICIPATES IN A PANEL DISCUSSION AT MICHAEL D. PENNER INSTITUTE CONFERENCE

OSFI (2024-05-03)

There are benefits to harmonizing regulatory requirements for financial institutions.

UK BANKS EARN OVER £9BN INTEREST ON RESERVES WITH BOE

Central Banking (2024-05-03)

Four major lenders in the UK earned a total of £9.3

TIFF MACKLEM SAYS HIGHER INTEREST RATES HAVING MORE BITE IN CANADA THAN U.S.

G&M - Mark Rendell (2024-05-02)

Mr.

U.S. FEDERAL RESERVE SAYS INTEREST RATES WILL STAY AT TWO-DECADE HIGH UNTIL INFLATION FURTHER COOLS

G&M - Christopher Rugaber (2024-05-02)

The Fed issued its decision in a statement after its latest meeting, at which it kept its key rate at a two-decade high of roughly 5.3

RUSSIA CAN'T MATCH A WESTERN ASSET SEIZURE, BUT IT CAN INFLICT PAIN

Reuters - Alexander Marrow (2024-05-02)

Russia's ability to mete out like-for-like retaliation if Western leaders seize its frozen assets has been eroded by dwindling foreign investment, but officials and economists say there are still ways it can strike back. The

AUSTRALIA BANKS FACE PROFIT SQUEEZE ON RISING COSTS, MORTGAGE COMPETITION

Reuters - Sameer Manekar (2024-05-02)

Australia's biggest banks are likely to report weaker first-half profit as high operating costs and competition to sell mortgages and deposits squeeze margins, setting up a possible reversal of a stock rally that analysts said has left the sector overheated. Traditionally

THIS CRATERING GDP NUMBER HAS ONLY EVER BEEN SEEN DURING A RECESSION

FP - Gigi Suhanic (2024-05-02)

The closely watched measure continued to crater and is now down three per cent from its peak in September 2022, according to Matthieu Arseneau, deputy chief economist at National Bank of Canada. âA

WHY BANKS THESE DAYS ARE SO EXCITED ABOUT BEING BORING

Bloomberg - Bre Bradham (2024-05-02)

In March, PNC Financial Services Group Inc.

CHRIS ROKOS’S $17 BILLION HEDGE FUND EXTENDS GAINS TO ABOUT 20%

Bloomberg - ishant Kumar and Liza Tetley (2024-05-02)

Billionaire Chris Rokosâs hedge fund cemented its position as one of the best performing macro money pools so far this year, with year-to-date gains now reaching about 20%. His

GREATER TORONTO RENTAL VACANCY RATE SOARS 30% HIGHER, PRICES BARELY MOVE

Better Dwelling (2024-05-02)

Inventories for newly-built (2003 or later) apartment rentals in the GTHA region have climbed significantly.

IVEY SUMMER PROGRAM AIMS TO ATTRACT WOMEN TO FINANCIAL SERVICES

Investment Executive (2024-05-02)

The summer program provides female undergraduate students with four weeks of in-class training, combined with a 10- to 12-week paid internship at an asset management firm.

ECHELON WEALTH PARTNERS FACES ACTION BY CANADA’S INDUSTRY REGULATOR OVER U.S. TRADING

G&M - DAVID MILSTEAD, CLARE OâHARA (2024-05-01)

Toronto-based brokerage Echelon Wealth Partners Inc.

TD BANK TAKES US$450-MILLION PROVISION RELATED TO PROBE WITH REGULATOR OVER ANTI-MONEY LAUNDERING WEAKNESSES

G&M - Stefanie Marotta (2024-05-01)

Toronto-Dominion Bank TD-T is setting aside US$450-million to cover penalties itâs facing as a result of a lengthy U.S.

DOLLAR NEAR FIVE-MONTH HIGHS AHEAD OF FED POLICY DECISION

Yahoo Finance - Alun John (2024-05-01)

"It's pretty clear from the way that the data has been that we're going to see a focus shift from the last Fed meeting, the question is the extent to which Powell has already previewed the shift of rhetoric when he last spoke," said Michael Sneyd, head of cross-asset and

IT'S OPENING DAY FOR THE $34 BILLION TRANS MOUNTAIN OIL PIPELINE EXPANSION

Yahoo Finance (2024-05-01)

The expansion increases the Trans Mountain system's shipping capacity from 300,000 barrels per day to 890,000 barrels per day, and will help open up global export markets for Canadian oil.

US POISED TO EASE RESTRICTIONS ON MARIJUANA IN HISTORIC SHIFT, BUT IT'LL REMAIN CONTROLLED SUBSTANCE

Yahoo Finance (2024-05-01)

Biden and a growing number of lawmakers from both major political parties have been pushing for the DEA decision as marijuana has become increasingly decriminalized and accepted, particularly by younger people.

FED TO SIGNAL DELAY OF INTEREST-RATE CUTS

Bloomberg - Steve Matthews (2024-05-01)

Federal Reserve officials are poised to keep interest rates steady for a sixth consecutive meeting and signal no plans for cuts in the near future after higher-than-expected inflation. The

WHY THE US DOLLAR IS CAUSING CHAOS ACROSS ASIA

Bloomberg - Marcus Wong (2024-05-01)

Emerging-market currencies have tumbled this year as the dollar has gone from strength to strength.

CANADIAN GDP GROWTH HITS HALF THE ESTIMATE, PREVIOUS DATA REVISED LOWER

Better Dwelling (2024-05-01)

Speaking of Januaryâs surprise growth, Stat Can made a downward revision to the month.

WHAT TRIGGERED NOEL QUINN’S SHOCK EXIT FROM HSBC

FT - Roula Khalaf (2024-05-01)

Please use the sharing tools found via the share button at the top or side of articles.

SCOTIABANK TAPS MORGAN STANLEY EXECUTIVE TO LEAD ITS GLOBAL BANKING AND MARKETS DIVISION

G&M - Stefanie Marotta (2024-04-30)

The move is the latest leadership changeover in the past year in which chief executive officer Scott Thomson has acquired talent from other financial institutions while promoting more junior executives through the ranks internally.

NATIONAL BANK OF CANADA TARGETS GLOBAL BORROWERS WITH PARIS HUB

Yahoo Finance - Chunzi Xu and Esteban Duarte (2024-04-30)

Simon Cote, who heads the London office, will also lead operations for the Paris branch, said Sean St.

GLOBAL BANKING REGULATORS TARGET MISMANAGEMENT IN HANDLING RISKS FROM CLIENTS

Yahoo Finance - Huw Jones (2024-04-30)

The Basel Committee, made up of banking regulators from the G20 economies and elsewhere, said banks needed to improve how they manage counterparty credit risks (CCR) presented by clients. It

HSBC CEO QUINN UNEXPECTEDLY STEPS DOWN AFTER ALMOST 5 YEARS

Yahoo Finance - Harry Wilson and Ambereen Choudhury (2024-04-30)

HSBC Holdings Plcâs Chief Executive Officer Noel Quinn is stepping down, an unexpected move that comes as Europeâs largest lender tries to navigate the deterioration of ties between China and the US. During

BARCLAYS SAYS IT’S WINNING ASIA BANKING BUSINESS FROM US FIRMS

Yahoo Finance - Cathy Chan (2024-04-30)

The additions include six directors for its macro unit trading currencies and rates who were hired from rivals including Goldman Sachs Group Inc.

OPEN BANKING COULD SPUR COMPETITION, BUT FINTECHS SAY CANADA'S MOVING TOO SLOWLY

CBC - Anis Heydari (2024-04-30)

During their long, decade-plus wait for open banking, some in the sector have blamed Canada's sluggish pace on the big banks trying to keep new up-and-comers out of the market.

THE FED’S QUANTITATIVE EASING PROGRAM COST TOO MUCH

Bloomberg - Bill Dudley (2024-04-30)

Americaâs experiment with quantitative easing is almost over.

SCOTIABANK HIRES TRAVIS MACHEN FROM MORGAN STANLEY TO RUN GLOBAL BANKING

Bloomberg - Gillian Tan and Christine Dobby (2024-04-30)

Travis Machen is joining Bank of Nova Scotia from Morgan Stanley to lead the its global banking and markets business. Machen,

FOREIGN INVESTMENT IN UK FINANCE SECTOR HALVES IN 2023, SAYS CITY OF LONDON

Reuters (2024-04-30)

Foreign investment in Britain's financial and professional services halved to one billion pounds ($1.25

REGULATORS CLOSE PHILADELPHIA-BASED REPUBLIC FIRST BANK, FIRST U.S. BANK FAILURE THIS YEAR

FP (2024-04-30)

The Federal Deposit Insurance Corp.

CANADIAN REAL ESTATE PRICES CLIMBED FASTER THAN MORTGAGE PAYMENTS

Better Dwelling (2024-04-30)

The price of a home generally rose faster than mortgage payments across Canada.

FRAUDSTERS FAKING IDENTITIES, DUPING BANKS

Investment Executive (2024-04-30)

Instead of using the stolen identities of real people, a Toronto-based fraud scheme was based on the manufacture of false identities, which duped financial institutions for at least $4 million, according to police.

RATINGS FOR GLOBAL FINANCIAL SECTOR TREND POSITIVE: FITCH

Investment Executive (2024-04-30)

Most global financial institutions (83%) had stable rating outlooks at the end of the first quarter, while 8% were on positive rating watch/outlook, and 6% faced negative outlooks (2% of issuers had no outlook, given their already rock-bottom ratings).

TORONTO SMALL BUSINESS FORCED TO CLOSE AFTER LOSING MONEY TO CHEQUE FRAUD THAT TD COULDN’T STOP

G&M - Chris Hannay (2024-04-29)

A Toronto staffing agency says it was forced to close its doors after losing hundreds of thousands of dollars to cheque fraud â and the former owners are asking why their bank was repeatedly unable to stop the scam from happening. The

FINANCIAL PESSIMISM RISING ALONGSIDE INTEREST RATES, INFLATION: “I’VE HAD TO REEVALUATE WHAT IS POSSIBLE”

G&M - Saira Peeker (2024-04-29)

âIn the last two years, Iâve had to re-evaluate what is possible,â says Mr.

GOVERNMENT HITS CANADA LIFE WITH FINANCIAL SANCTIONS

CBC (2024-04-29)

The federal government has begun imposing financial sanctions on Canada Life after months of outcry from public servants, retirees and their families who were left fighting for medical claims to be covered.

OPEN BANKING COULD SPUR COMPETITION, BUT FINTECHS SAY CANADA'S MOVING TOO SLOWLY

CBC (2024-04-29)

Open banking lets consumers or business customers share personal and financial information between approved banks and other companies.

GOLD COULD GO AS HIGH AS $3,000, FORECASTERS SAY

FP - Larysa Harapyn (2024-04-29)

John Ciampaglia, chief executive at Sprott Asset Management LP, talks with Financial Postâs Larysa Harapyn about how gold has decoupled from its usual drivers as central banks in the east snatch up the yellow metal.

'IT'S CLEAR' MARK CARNEY WANTS TRUDEAU'S JOB AND SHOULD APPEAR AT COMMONS COMMITTEE: CONSERVATIVES

FP - Catherine Levesque (2024-04-29)

Even though Prime Minister Justin Trudeau has repeatedly said he is staying on as leader of his party, the ongoing speculation about Carneyâs political prospects has only intensified in recent months, and more so after he delivered a speech Monday evening during which he criticized the federal budget.

CANADA'S RETAIL SALES FLATLINE, SUPPORTING CASE FOR BANK OF CANADA RATE CUT

FP - Randy Thanthong-Knight (2024-04-29)

Taken together with the 0.3

HALF OF RUSSIA'S PAYMENTS TO CHINA MADE THROUGH MIDDLEMEN, SOURCES SAY

Reuters (2024-04-29)

Russian firms' efforts to make payments for goods in China as secondary sanctions fears spook local banks have generated a flourishing market for middlemen, four sources told Reuters, with up to half of transactions now handled by intermediaries. The

GOLDMAN TO BANKERS: NO SNEAKY TRIPS TO PARIS DURING OLYMPICS

Bloomberg - Denise Wee and Alexandre Rajbhandari (2024-04-29)

For Goldman Sachs Group Inc.

TITLE PROTECTION IN CANADA MUST PUT CONSUMERS FIRST

Investment Executive - Tasia Batstone (2024-04-29)

Prioritizing clientsâ best interests is not just a regulatory or professional obligation for financial advisors and financial planners; it is a fundamental principle that underpins integrity, trustworthiness and success in financial services.

THIS IS AN ACCOUNT OF THE DELIBERATIONS OF THE BANK OF CANADA’S GOVERNING COUNCIL LEADING TO THE MONETARY POLICY DECISION ON APRIL 10, 2024

BOC (2024-04-29)

International financial conditions had continued to ease since the January Monetary Policy Report, as the global economic outlook improved, and the risk of a recession diminished.

BRIDGEWATER BANK NAMES NEW CHIEF RISK OFFICER

Mortgage Broker News (2024-04-29)

Michelle Chimko, president of the Alberta Motor Association, commented on the appointment in a recent news release and said they are âdelightedâ to welcome Kent as Bridgewaterâs new CRO.

BOC WANTS INFLATION TO EASE FURTHER BEFORE LOWERING RATES

Mortgage Broker News (2024-04-29)

Some members were wary of upside inflation risks spurred by stronger economic growth in the US and recent domestic improvements, as indicated by a more robust GDP growth forecast.

COULD RATE CUTS REVIVE THE BC HOUSING MARKET IN 2024?

Mortgage Broker News (2024-04-29)

Based on these trends, BCREA said it is expecting the Bank of Canada to initiate policy rate cuts as early as June 2024, potentially reaching up to 100 basis points by the yearâs end.

MAJORITY OF ASPIRING CANADIAN HOMEOWNERS AWAITING RATE CUTS BEFORE BUYING, SURVEY SHOWS

G&M (2024-04-29)

The majority of Canadians aspiring to buy a home say they will push their plans to next year or later to wait for interest rates to drop, a new survey shows. Bank

FORGET RATE RELIEF: MOST CANADIANS ARE ABOUT TO SEE THEIR MORTGAGE INTEREST PAYMENTS SOAR

G&M - JAMES LAIRD AND PENELOPE GRAHAM (2024-04-26)

In Canadaâs mortgage market, sentiment can shift on a dime. Thatâs

THE PAY FOR MANULIFE’S CEO IS HEAD AND SHOULDERS ABOVE PEERS

G&M - David Milstead (2024-04-26)

Manulife paid Mr.

OTTAWA SET TO LOWER MAXIMUM INTEREST RATE ON CONSUMER LOAN PRODUCTS

G&M - Kelsey Rolfe (2024-04-26)

Ms.

GOLDMAN, MORGAN STANLEY PREP €1 BILLION FOR CVC’S MULTIVERSITY

Yahoo Finance - Eleanor Duncan and Giulia Morpurgo (2024-04-26)

Banks including Morgan Stanley and Goldman Sachs Group Inc.

GOLD HEADS FOR WEEKLY LOSS AS US INFLATION CONCERNS SAP DEMAND

Yahoo Finance - Sybilla Gross (2024-04-26)

The precious metal dipped on Friday and was down 2.7%

WHAT COULD A $5B GOVERNMENT LOAN PROGRAM DO? TURN INDIGENOUS COMMUNITIES INTO POWERFUL INVESTORS

CBC - James Dunne (2024-04-26)

Michell and Lickers were speakers and among 500 Indigenous representatives at the seventh annual First Nations Major Project Coalition (FNMPC) conference, which also attracted 1,100 delegates from companies as well as high-profile politicians.

JAVIER MILEI FUELS WILD RALLY THAT MAKES PESO NO. 1 IN WORLD

Bloomberg - Ignacio Olivera Doll (2024-04-26)

Four months into office, Argentine President Javier Milei has pulled off a critical feat in a country long ravaged by runaway inflation: He stabilized the currency. The

TORONTO MORTGAGE DELINQUENCY RATE SURGES 71% HIGHER

Better Dwelling (2024-04-26)

Itâs important to remember that delinquencies arenât a sign of payer health, but demand.

EMPLOYMENT NUMBERS SLIDE IN FEBRUARY

Investment Executive (2024-04-26)

The national statistical agency reported total payroll employment declined by 0.1%

THE DREAM OF FED INTEREST-RATE CUTS IS SLIPPING AWAY

WSJ (2024-04-26)

Investors are backing away from expectations that the central bank can reduce rates in coming months, hitting markets, with the yield on 10-year Treasurys jumping above

CANADA’S PER CAPITA OUTPUT DROPS 7% BELOW TREND, NEW STATSCAN REPORT SAYS

G&M - Matt Lundy (2024-04-25)

Canadaâs economic output on a per capita basis has slipped to 7 per cent below its long-term trend, amounting to a decline of roughly $4,200 a person, according to a report published Wednesday by Statistics Canada. To

BANK OF CANADA OFFICIALS SPLIT ON RATE CUT TIMING, BUT AGREE EASING WILL BE GRADUAL

G&M - Mark Rendell (2024-04-25)

âIf we get a fourth straight subdued CPI report next month, it looks like the BoC will strongly consider cutting policy rates in June,â Benjamin Reitzes, director of Canadian rates and macro strategist at Bank of Montreal, said in a note to clients.

FIERA CAPITAL’S LARGEST SHAREHOLDER LOOKS TO SELL STAKE IN COMPANY

G&M - Jameson Berkow (2024-04-25)

Desjardins Financial Holding Inc.,

‘IT’S CHAOS:’ COTTAGE OWNERS RUSH TO SELL AHEAD OF CAPITAL GAINS TAX CHANGES, REALTORS SAY

G&M - Jenna Legge (2024-04-25)

The federal budget released last week proposes to raise the inclusion rate on capital gains greater than $250,000 from 50 per cent to 66.7

EX-BANKER FIXING AMERICANAS’ $5 BILLION FRAUD AIMS FOR ‘EQUALLY DISTRIBUTED’ PAIN

Yahoo Finance - Daniel Cancel (2024-04-25)

âBankruptcies are painful processes,â she said.

FORMER SNC-LAVALIN EXECUTIVE SENTENCED TO PRISON TERM IN MONTREAL BRIDGE BRIBERY CASE

CBC (2024-04-25)

The police investigation revealed that SNC-Lavalin executives paid bribes of $2.23

CANADIAN BANKS NEED TO DO MORE TO STOP ABUSIVE E-TRANSFERS, SURVIVORS SAY

CBC - Katie Nicholson, Victoria Stunt (2024-04-25)

He even used spoofed phone numbers to break through the wall she had tried to build for herself.

CANADA’S BIGGEST INDIGENOUS-OWNED BANK PLANS MAJOR EXPANSION

Bloomberg - Thomas Seal (2024-04-25)

Canadaâs biggest Indigenous-owned bank is planning a major expansion that will raise as much as C$50 million ($36 million) to reach more customers. Saskatoon-based

IN DEFAULT ON $154 BILLION OF DEBT, VENEZUELA IS READY TO TALK

Bloomberg - Nicolle Yapur and Zijia Song (2024-04-25)

After years of fits and starts, Venezuela is setting the stage for one of the largest and most complex debt restructurings in decades â unwinding a $154 billion web of defaulted bonds, loans and legal judgments owed to creditors from Wall Street to Russia. President

CANADIAN GOVERNMENT BORROWED THE MOST FROM BOND MARKETS SINCE 2021

Better Dwelling (2024-04-25)

The latest budget also proposes a significant increase in spending, likely to drive more bond issuance.

REVOLUT TO GROW HEADCOUNT BY 40%

Finextra (2024-04-24)

The announcement comes as the company reaches 10,000 employees globally, and continues to grow its workforce, with over 70 roles currently advertised in the UK.

AT WHAT AGE DO CANADIANS START THEIR CPP PENSIONS? AND WHAT AGE SHOULD THEY START?

G&M - Frederick Vettese (2024-04-24)

For many years, I have recommended that people start their CPP pensions at age 70.

FEDERAL WATCHDOG EXPRESSES 'SERIOUS' CONCERNS ABOUT US$8.2B AGRI-BUSINESS DEAL

Yahoo Finance - Jeff Lagerquist (2024-04-24)

The federal competition watchdog released a report on Tuesday stating the combination would cause a âsignificant loss of rivalry.â

GOLD EXTENDS TWO-DAY DROP AS ATTENTION TURNS TO FEDERAL RESERVE

Yahoo Finance - Sybilla Gross and Jack Ryan (2024-04-24)

Bullion was trading near $2,300 an ounce after dropping about 3% this week as an easing of tensions in the Middle East sapped haven demand. The

VISA IS THE 12TH MOST VALUABLE COMPANY IN THE WORLD

CBC (2024-04-24)

It doesnât make anything, it doesnât sell anything and it doesn't even issue cards.

HOME RENOVATIONS ARE BOOMING THANKS TO HIGH RATES

Bloomberg - Laura Bliss and Minh-Anh Nguyen (2024-04-24)

In the early days of the pandemic, rock-bottom loan rates fueled a rise in US home sales as well as renovation spending.

JAMIE DIMON HAS A RIVAL IN TECH: SILICON VALLEY BANK

Bloomberg (2024-04-24)

Since Silicon Valley Bank became the second-biggest failure in US history a year ago, other lenders have been trying to take its place in banking the fast-moving, entrepreneurial world of startups and tech companies.

HOW JPMORGAN’S CASH CALL BEAT BANK OF AMERICA

Bloomberg - PAUL J. DAVIES (2024-04-24)

When the Federal Reserve flooded the economy with cash during the Covid-19 pandemic it exacerbated a problem for Americaâs largest banks: What to do with all the extra deposits. Now

WALMART-BACKED FINTECH ONE LAUNCHES 'BUY NOW, PAY LATER' SERVICES, SOURCE SAYS

Reuters (2024-04-24)

Walmartâs (WMT.N),

US SEEKS 36 MONTHS' JAIL FOR BINANCE FOUNDER ZHAO

Reuters (2024-04-24)

Changpeng Zhao, the founder of Binance, the world's largest cryptocurrency exchange, should serve 36 months in prison after pleading guilty to violating laws against money laundering, U.S.

CANADIAN MORTGAGE CHANGES BLUR THE LINE BETWEEN NORMAL & CRISIS

Better Dwelling (2024-04-24)

Canada is taking crisis-style mortgage market intervention, and making it an everyday thing.

UNDERUSED HOUSING TAX TO GENERATE $694 MILLION: PBO REPORT

Investment Executive - Rudy Mezzetta (2024-04-24)

The 2021 federal budget estimated the UHT would generate $700 million over four years, with $200 million of that amount raised in 2022â23.

LENDERS FLYING BLIND ON PRIVATE EQUITY RISK, BANK OF ENGLAND WARNS

FT (2024-04-24)

Some banks are unable to quantify their exposure to private equity, the Bank of England has found, in the latest warning that the $8tn industry could threaten the wider financial system. BoE

DIMON CAUTIONS OVER SOFT LANDING FOR ‘UNBELIEVABLE’ US ECONOMY

Reuters - Nupur Anand (2024-04-24)

JPMorgan Chase (JPM.N),

“UBIQUITECH” THE FIVE KEY PILLARS FOR DIGITAL TRANSFORMATION

Finextra (2024-04-23)

In this episode of Unplugged, Ruth Wandhofer, Chair of the Ubiquitech Group, discusses the UKâs transition from Fintech to âUbiquitechâ, the era of ubiquitous technology, and the road map to ensuring a sustainable, inclusive, and accessible digital economy.

UK FINANCE DEVELOPS MODEL CLAUSES FOR VARIABLE RECURRING PAYMENTS

Finextra (2024-04-23)

The model clauses, they say, will help with driving competition, increasing efficiencies by removing some of the transaction cost of bilateral negotiations between payment providers, and ensuring banking customers have a consistent experience.

FINANCIAL EXPERTS SEE LOWER RECESSION RISK, SLOWER RATE CUTS

Yahoo Finance - John MacFarlane (2024-04-23)

The expertsâ median forecast for the BoCâs benchmark interest rate at the end of 2024 is unchanged at four per cent (from the current level of five per cent), but fewer think it will go lower than that.

UBS DIALS BACK CHINA FUND PLANS ON HIGH COSTS, GRIM OUTLOOK

Yahoo Finance (2024-04-23)

Establishing a wholly-owned fund management firm would require large capital commitments, while the chances of turning a profit in the near term remain low, the people said.

WHEN JAMIE DIMON SPEAKS, THE WORLD LISTENS

Bloomberg (2024-04-23)

Emily Chang interviews JPMorgan Chief Executive Officer Jamie Dimon, a titan in the banking industry known for his freewheeling style, about his outlook on markets, tech and geopolitical risk.

US CONSUMERS ON LOWER INCOMES FACE LOAN STRESS WHILE BANKS PULL BACK

Bloomberg - Nupur Anand (2024-04-23)

U.S.

BANKERS LOSE HOPE OF LONDON IPO REVIVAL FOR ANOTHER YEAR

Reuters - Pablo Mayo Cerqueiro and Sinead Cruise (2024-04-23)

Part of the reason is the sluggishness of Britain's economic recovery and a perception its stock market is undervalued. Bankers

CANADIAN ANTI-MONEY LAUNDERING REPORTING SYSTEMS STILL DOWN POST-HACK

Better Dwelling (2024-04-23)

The agency has been fairly tight lipped about the incident, but they began dealing with it on March 2.

CANADIAN HOUSEHOLD DEBT NEARS $3 TRILLION, OVER 130% OF GDP

Better Dwelling (2024-04-22)

The latest numbers put the Canadian household debt to GDP ratio at roughly 132% in February.

HOW MUCH IS TOO MUCH? ANALYZING THE U.S. AND CANADA’S GOVERNMENT DEBT PROBLEM

G&M - Jason Kirby (2024-04-22)

Nearly two decades ago, David Walker went on tour across the United States.

NATIONAL BANK CEO CALLS ON OTTAWA TO REMOVE REGULATORY BARRIERS TO GROWTH

G&M - Stefanie Marotta (2024-04-22)

In March, Mr.

HALAL MORTGAGES IN FEDERAL BUDGET ABOUT 'BEING EQUAL' FOR MUSLIMS, PROVIDERS SAY

CBC - Anis Heydari (2024-04-22)

However, the lack of legal definitions specific to the interest-free nature of Islamic mortgages has often meant many mortgage insurance providers do not insure them â in particular because each halal provider may structure their mortgage differently, and uninsured mortgages can sometimes be more expensive.

OTTAWA TO FORCE BANKS TO USE CARBON REBATE LABEL FOR DIRECT DEPOSITS

CBC - Mia Rabson (2024-04-22)

TD and BMO have adopted the government's requested "CdaCarbonRebate" entry, which fits the 15-character limit imposed by some banks.

BARCLAYS, BNP, DEUTSCHE BANK EARNINGS HINGE ON TRADING, RATES

Yahoo Finance (2024-04-22)

A combined â¬5 billion ($5.3

UK ECONOMISTS SAY MARKETS BETTING WRONG ON INTEREST RATE CUTS

Yahoo Finance (2024-04-22)

âMarkets have superimposed the US cycle on the UK, but the US and UK are on very different tracks,â said Sanjay Raja, chief UK economist at Deutsche Bank.

MACQUARIE'S BANKING UNIT TO STOP NEW CAR LOANS TO FOCUS ON MORTGAGE GROWTH

Yahoo Finance (2024-04-22)

"This decision will enable us to further prioritise the growth of our home loan and deposit offerings," Ben Perham, Macquarie's head of personal banking, said in a statement.

DIMON MEETS WITH DEVELOPMENT BANK LEADERS SEEKING PRIVATE MONEY

Yahoo Finance (2024-04-22)

The World Bank and other development lenders are striving to retain relevance as their capacities are far outstripped by the needs of poorer countries, particularly for capital-intensive climate-related projects.

THE FED’S FORECASTING METHOD LOOKS INCREASINGLY OUTDATED AS BERNANKE PITCHES AN ALTERNATIVE

Bloomberg (2024-04-22)

The Federal Reserve is stuck in a mode of forecasting and public communication that looks increasingly limited, especially as the economy keeps delivering surprises. The

FED SAYS 1,804 BANKS AND OTHER INSTITUTIONS TAPPED EMERGENCY LENDING FACILITY

Reuters (2024-04-22)

About 95% of the borrowers, which included banks, credit unions, savings associations, and branches and agencies of foreign banks, had less than $10 billion in assets, the U.S.

CIFP SUES FP CANADA FOR AGREEMENT BREACH, TRADE LIBEL

Investment Executive - Michelle Schriver (2024-04-22)

CIFP filed the claim on Wednesday with the Ontario Superior Court of Justice in Toronto.

GLOBAL CREDIT RISKS ABOUND, EVEN AS GROWTH SURPRISES

Investment Executive (2024-04-22)

âThe secular shift in commercial real estate remains a key cross-sector risk and the geopolitical environment also maintains a negative risk bias given the potential for tail risk scenarios in Europe, the Middle East and Asia-Pacific,â Fitch said.

News feed

NEW CONDO SALES IN THE TORONTO AREA HIT 15-YEAR LOW

G&M - Rachelle Younglai (2024-08-23)

The slowdown has imperilled the construction of homes at a time when governments are trying to spur more building in a bid to make housing more affordable.

MASTERCARD FOUNDATION LAUNCHES TORONTO-BASED ASSET MANAGER TO OVERSEE $47-BILLION IN INVESTMENTS

G&M - James Bradshaw (2024-05-03)

One of the worldâs largest private charitable organizations, the Mastercard Foundation, is creating a separate Toronto-based asset manager from scratch to modernize the way it invests its US$47-billion portfolio â a vast pool of wealth built from owning a single stock. Mastercard

U.S. PROBE OF TD BANK TIED TO US$653-MILLION MONEY-LAUNDERING AND DRUG-TRAFFICKING CASE

G&M - Tim Kiladze (2024-05-03)

Toronto-Dominion Bankâs TD-T lengthy regulatory and law enforcement investigation in the United States is tied to a US$653-million money-laundering and drug-trafficking operation, a revelation that finally sheds light on American regulatorsâ decision to block TDâs multibillion-dollar U.S.

RENTAL HOUSING INVESTOR STARLIGHT HIT BY RISING REAL ESTATE SUPPLY IN U.S., COMPOUNDING PAIN FROM HIGHER RATES

G&M - Tim Kiladze (2024-05-03)

Starlight Investments, run by Canadian real estate magnate Daniel Drimmer, launched two funds that invested in U.S.

News feed

FSIM briefings and developments reports

UK BANKS EARN OVER £9BN INTEREST ON RESERVES WITH BOE

Four major lenders in the UK earned a total of £9.3 billion ($11.6 billion) in interest from their reserves with the Bank of England (BoE) last year, data published by a parliamentary committee shows. The figure represents a 135% increase compared with 2022. The central bank pays interest on the reserves held with it by commercial banks at the current bank rate of 5.25%. A sharp increase in interest rates since 2021 has driven a significant jump in the banks’ earnings, at the expense of the BoE

ASSISTANT SUPERINTENDENT TOLGA YALKIN PARTICIPATES IN A PANEL DISCUSSION AT MICHAEL D. PENNER INSTITUTE CONFERENCE

There are benefits to harmonizing regulatory requirements for financial institutions. With respect to climate risk, OSFI recognizes the importance of not creating undue complexity in this area. For this reason, we updated Annex 2-2 of our Guideline B-15 last March to align it with the International Sustainability Standards Board’s (ISSB) final IFRS S2 Climate-related Disclosures standard. This streamlines climate-related reporting and promotes transparency of climate risk.

CANADIAN HOUSING AGENCY BIZARRELY FORECASTS RECORD HOME PRICES & WEAK ECONOMY

The CMHC sees home prices rising at a face-ripping rate across the country. They’re currently forecasting the average sale price of an existing home will rise 20.1% (+$136,600) by the end of 2026. It goes from $678,300 in 2023 to a whopping $814,900 in 2026.